Project Description

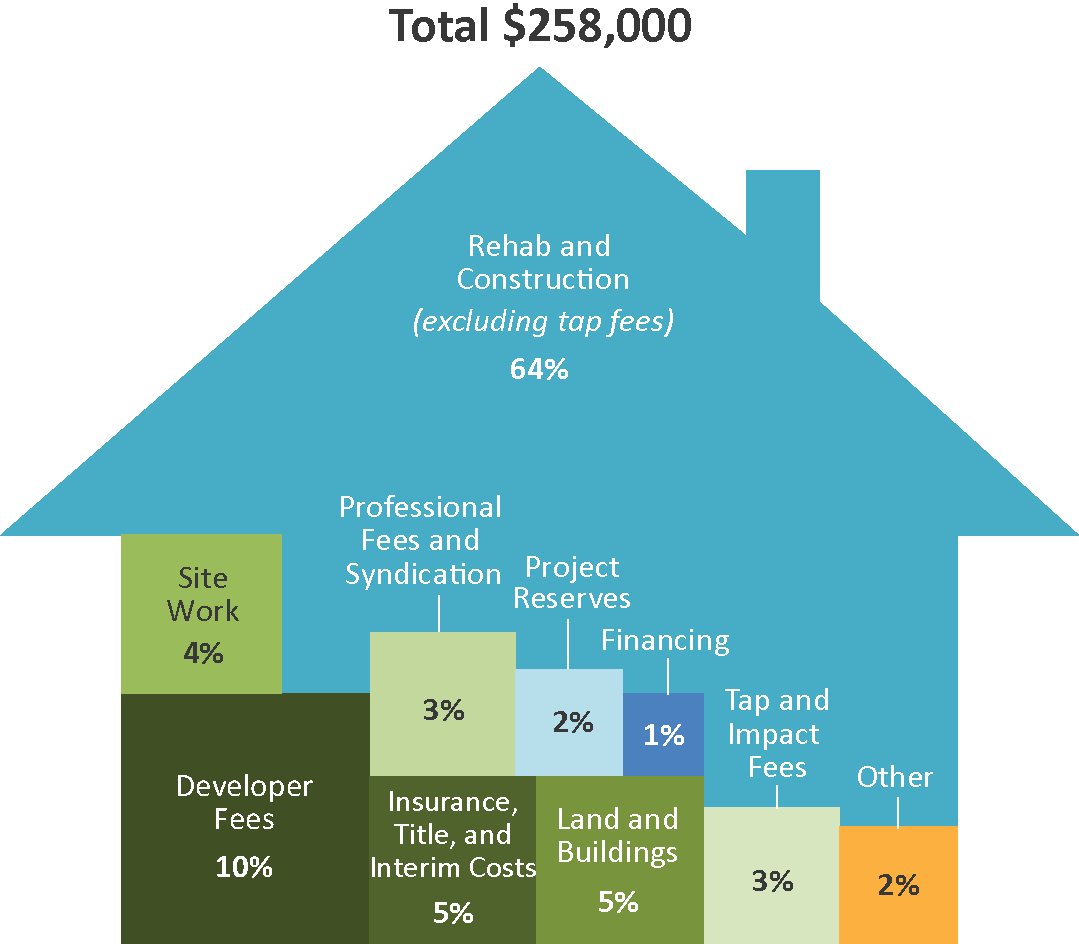

Our team completed a study for the Colorado Housing and Finance Authority (CHFA) that examined trends in the cost of developing Low Income Housing Tax Credit (LIHTC) developments. The purpose of the study was to determine the underlying causes of significant increases in development costs and how state and local governments can help contain costs. In addition to the data analysis, we conducted a review of the Qualified Allocation Plan (QAP) for potential fair housing barriers and made a presentation to the CHFA Board on how the disparate impact Supreme Court ruling in 2015 may affect CHFA.

Year: 2016

Fun Fact

Rising labor costs contributed the most to overall cost increases.